Buying High and Selling Low: The Dangers of Reactionary Manager Selection and Turnover in Retirement Plans

It’s an all too common problem – and the usual reaction makes a lot of sense. An active manager is underperforming its benchmark and peer group over a short-term period. The fund is placed on watch and quickly replaced by a fund with strong performance over the same short-term period.

In a healthy sponsor/advisor relationship, it is impossible to avoid manager turnover. However, continual turnover can come at a cost and often times, it’s at the expense of returns for participants.

Problem:

Markets are cyclical. Market conditions will favor various asset classes and management styles at times and be unfavorable at others. This is where the problem of manager turnover arises.

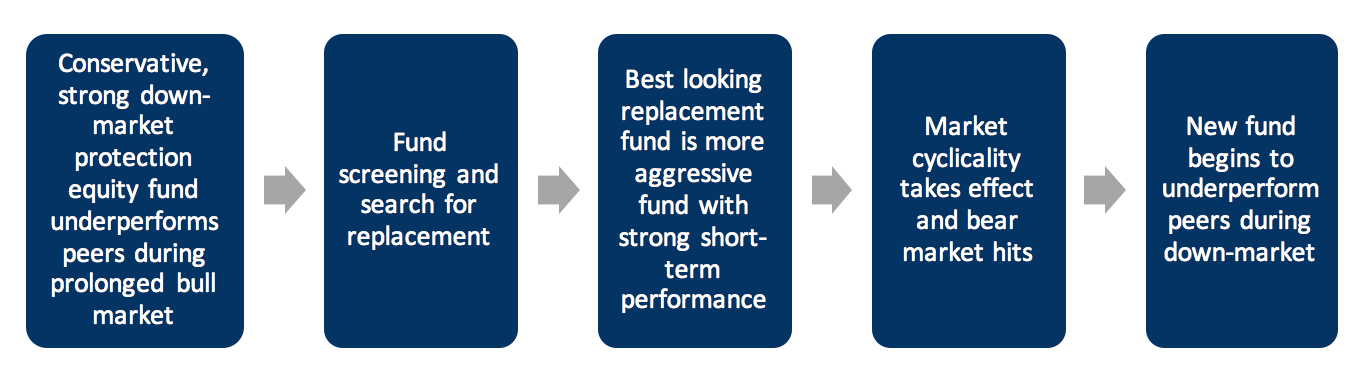

We are currently in the middle of a sustained bull market where equities, particularly smaller cap equities have had consistently strong returns. Let’s say that a plan sponsor has chosen to use a conservative small cap manager that protects well during down-markets. If we examine this scenario and assume a multi-year bull market, the order of events would usually look like this:

Result

The conservative fund was sold at a low price point compared to peer funds at the peak of the bull market and participant dollars bought into a more aggressive fund at its highest price point. Mutual fund shares were sold low and then bought high. Now, participants must suffer through the market correction with a riskier fund.

Solutions:

Plan sponsors and advisors should have an understanding that markets are cyclical and patience during unfavorable market conditions is often the best course of action. Given a prudent selection process, short-term underperformance is often not the best reason for manager replacement. In most cases, this type of reactionary manager turnover comes at a cost, and that cost is borne by the beneficiaries of a retirement plan.

Retirement and investment plans should have a well-considered and well-documented Investment Policy Statement. While maintaining flexibility, the IPS should reflect specific plan requirements and preferences. This allows the committee to easily look at manager and investment decisions and see if they remain consistent with the stated plan goals. It also ensures that decisions around fund selection and asset class exposure are specific to the plan.

The IPS should also include performance guidelines and a process for manager evaluation and replacement. This process should consider current market conditions, plan suitability, long-term performance, and qualitative factors.

Qualitative changes to a fund such as management turnover, a change in investment style or philosophy (i.e. value to growth or small cap to mid cap), or fee increases should be of concern to Plan Sponsors.

If proper research and due diligence are performed during the selection process and the fund’s investment strategy remains intact, generally the fund will continue to be an appropriate selection in the Plan. This form of due diligence when selecting funds along with an understanding of the cyclicality of markets are building blocks for the long-term success of both a plan and it’s participants.